In Spot Light: SDS Cross-Market Finance Resource Sharing Platform Supports RMB Oil Futures

2018-03-30

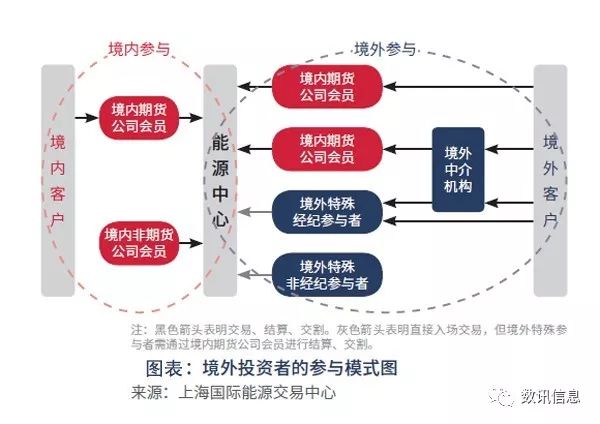

At 9:00 a.m., March 26th, 2018, the Crude Oil futures contracts were officially listed in Shanghai International Energy Exchange (INE) for trading. Attracting the attention of the world, the Crude Oil contract is the first Chinese commodity futures product opened for international investors. It’s expected that the launching of Chinese crude oil futures product would help establishing a benchmark price system that reflects the supply-demand relation in Asia-Pacific oil market and, subsequently, lays a solid foundation for China participating in international crude oil pricing. It is also expected that pricing and settling of the oil futures in RMB would pave a way for the further internationalization of RMB. It’s unprecedented in industrial history that the Mr. Ying Yong, the Mayor of Shanghai Municipal Government, Mr. Ying Yong, the Secretary of Shanghai Municipal CPC, Mr. Liu Shiyu, the Chairman of CSRC, and many other senior leaders from the CSRC and industrial authorities, came to witness the moment.

On the first trading day, the interested organizations that participated into the auction of first transactions included some large SOEs, e.g. China National United Oil Corporation (CNUOC) and China National Offshore Oil Corporation (CNOOC), and some foreign-invested companies. It’s worth mentioning that overseas investors also actively took part in the trading. Relying on the trading systems of domestic futures companies that can ensure fast and stable transaction, they closed deals of crude oil contracts for overseas investors. The most cheering news is that the first closed order was made by a brokerage that uses SDS hosting services and quick futures solution. Mr. Wang Xiao, the Crude Oil Futures Director of GuoTai JunAn Securities commented that “From the distribution of traders who made the first closed deals, we can see that the launching of Chinese Crude Oil futures has already released an impact to the world market and Chinese Crude Oil futures have already been recognized by the global crude oil market. Players in world crude oil market would start paying greater attention to and participate into this market.”

The good start to the Crude Oil futures owes a great deal to the supports from Chinese exchanges and relevant state authorities. The stimulus policies like zero position-closing service fee and zero corporate income tax to overseas institutional investors, largely improved the volume of the first day’s crude oil transaction. There is one detail about trading cost and investment return worth mentioning here. Currently, the exchanges charges transaction service fee at a price of RMB 20 per lot, and, the futures companies charges the same fee at a price of RMB 30 per lot. On the other hand, the minimum price fluctuation of crude oil futures is RMB 0.1, and, the contract size per lot is 1,000 barrels. That is to say, one single price fluctuation is already enough for a trader to cover the cost of opening a position while ensuring a profit of RMB 50 per lot. Obviously, the Chinese crude oil futures offer high ‘value for money’ to participants of day trading. And, exactly because of their participation, the market found the strong support from a great enough liquidity.

As a member company in the same category of that of the three futures exchange under China Futures Association, Shanghai Data Solution provides a futures service platform that has been well recognized and trusted among domestic futures companies. Along with the trend of China financial market opening up to the outside world, SDS will deeply root itself in the market, devote itself to providing rules-complied and most effective platform tools for members of futures companies, and do its best to develop better trading platform that features higher efficiency, greater specialty and wider coverage.

According to the specifications, instructions and opinions from state finance regulatory authorities and the technological companies under domestic exchanges, SDS answered the calling for building intensified platforms, focused on helping member companies to reduce costs, and, with the support from the technological companies and member companies, created more paths for the interconnection in financial industry and, eventually, built a unique finance platform in China. In Particular, with the support from the technological companies, we could better help them to provide better services to the member companies of exchanges, while meeting all the requirements of the industrial regulatory authorities. By doing so, we hope we could rapidly grow into a high-class datacenter service provider that have key players in the finance, futures, banking, payment, and World Top 500 companies as our key customers.

SDS has been working hard to develop datacenters of the highest level. Up to now, LanGuang Data Center and JinQiao Data Center have been operating for 10 years and 5 years without any serious incident. We have been sticking to the guideline of ‘Serving industries, rule-complied management, stable operation and guaranteed trading services’ and, consequently, have received a unanimous recognition from our users over the past five years.

SDS is now hosting operational systems for nearly 50 domestic futures companies. Relying on the advantage that it is interconnected with all Chinese exchanges, SDS is able to provide futures customers with a very good platform and, at the mean time, with the support from technological companies under the exchanges, set up for futures members a complete industrial ecosystem that enables all involving parties to help each other move forward and achieve mutual development and growth.

It’s been many times that state industrial authorities urged that the innovation in finance industry should be centered on releasing financial power into real economy. It’s SDS’s goal to be the connector that helps the exchanges’ technology companies to dock with the customers and business scenarios that they wish to reach. The goal of this mutually developed finance ecosystem is to get through the last mile of the finance industry. After years of hard work and based on the reliable service quality, professional O&M team, and extensive experiences, SDS not only has strongly established itself in the high-class datacenter industry, but also is making a great contribution to the development of Chinese finance futures industry. In coming years, SDS will continue working hard to understand industrial needs, improving services and service quality, and help Chinese exchanges and their technological subsidiaries to provide their member companies with better services.

中文

中文