SDS Clouds Empower Financial New Infrastructure

2020-09-18

On September 18th, 2020, Shanghai, the FinTech Show 2020 Financial New Infrastructure Summit was held successfully. On invitation, the SDS took part in the event together with over 250 distinguished guests, mostly middle and senior backbone IT staff from banking, insurance, funds, stock exchange, trust, asset management, leasing, internet finance, and others from financial industry, and shared its views on the comprehensive tele-communication services for new financial industries in a presentation, i.e. the SDS Clouds Empower Financial New Infrastructure.

According to the FinTech Development Planning (2019-2021) recently issued by the People’s Bank of China, China expects to have generally established the 4B8P Frame (the essential 4 beams and 8 pillars required to set up the fundamental framework of a building) for the financial technological development by 2021, further enhance the high-tech application capability in financial industries, and achieve a profound combination of finance and high-tech and coordinated development of both industries.

As Mr. Brett King said in his BANK 4.0, a hit in 2019 book market, “Banking everywhere, never at a bank”, more and more Chinese banks have worked out their digitalized banking service strategies to gain greater competitive edge. But up to today, they have had only about 30% of their core banking systems replaced and there are still a lot of systems waiting to be reformed. On the other hand, according to Ernst & Young’s 2018 Global Banking Outlook (IT Section), while proceeding with the replacement, only 37% banks wished to develop new technologies and new systems on their own. Seeing this, the SDS launched a comprehensive communication service for the new finance industries to give them a base platform upon which they could achieve deeper integration, better use of existing resource, greater innovation and faster development, and eventually offer their customers with more new data-based innovative financial services. The SDS hopes that, by doing so, we could help Chinese financial institutes achieve more successes in the era of New Infrastructure centering on ‘data center, Cloud services and network convergence’.

Photo: Zhang Ying, SDS Product Manager, introducing the SDS’s comprehensive communication service for the new finance industry

In this FinTech Show, Mz. Zhang Ying, the SDS Product Manager, delivered a very clear presentation of the SDS Financial New Infrastructure Services in front of the audiences. Based on the guideline of ‘DC-Cloud-Network Integration, Hybrid Hosting, High Availability and Legendary Service’, the SDS is committed to providing brand new communication services that has deeply integrated the 4 core elements of our business, i.e. data center, Cloud computing, network service, and various value-added IT services. As a matter of fact, with the high quality, high availability and cutting-edge technologies in its communication services, the SDS has already earned the trust of many financial institutes.

The sudden attack of COVID-19 pandemic, and the New Infrastructure (represented by 5G, AI, IoT and Gig Data technologies) that Chinese government is strongly promoting, have made it very clear the importance of non-contact, APP-based and remote services in the financial industry. On the other hand, the huge growth of SaaS business has lead to higher requirements on the security, stability and fast expansion capacity of all Cloud computing products in the market. Specifically, the mobile-offices and Cloud computing infrastructures that can easily absorb the shock-waves of bursting service callings are now of particular importance. The comprehensive IT solutions featuring better integration, versatility and forward-looking designs have already set off fervent response from the market.

Now, more and more financial software systems have been equipped with the capacity of providing services in the forms of API Calling, SaaS and PaaS, in order to give financial customers more and timelier product and function options. It’s clear that, from peripheral business to core business, from innovative business to traditional business, from low-frequency business to high-frequency business, the financial sector is moving on Clouds in firm steps. Therefore, the market demand for effective and efficient network and multi-Clouds management is surging. In terms of IT support, it is necessary to build an effective management platform that can not only handle private Clouds and public Clouds, but also maintain great inter- connection of Clouds.

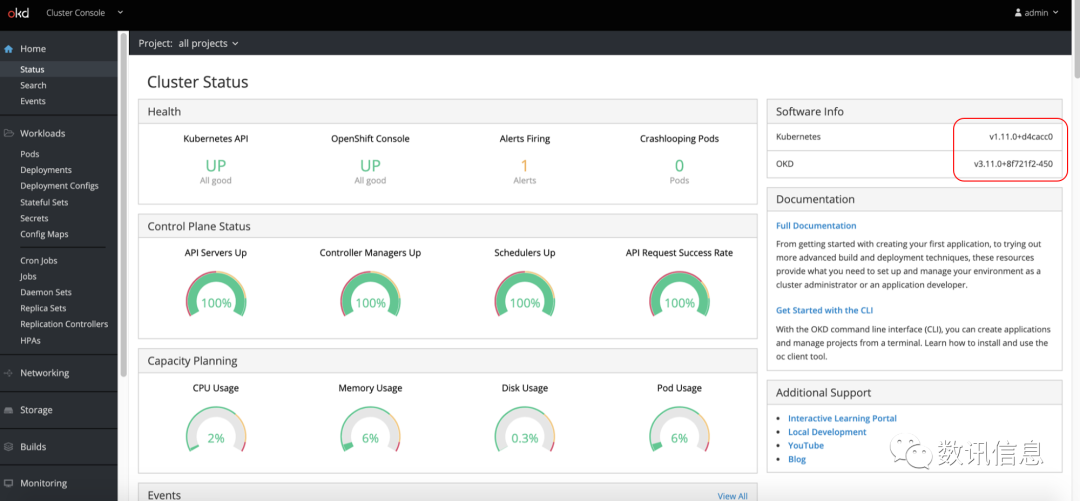

This is where SDS Container Cloud, a great choice for all users, finds its place. With the help of SDS Clouds, a user may keep unified control and monitoring over the status of both physical and virtual machines distributed all over the country. In addition, the deployment and initialization of a SDS Container can be so easy and convenient that the service response can be measured at the scale of second, which leads to a significant reduction of response time and costs. Moreover, the SDS Container Cloud supports DevOps development and deployment models, an advantageous feature that enables many developers to run containers directly in a production environment and ensure timely iteration.

The SDS Container Cloud is a platform based on Docker and K8S technologies and re-developed on the basis of OKD technologies. It has in itself an internal application store that offers various middleware, databases and automated processes that enable users to accomplish application construction, containerization, deployment and linking throughout the process of application development, tests and go-live. It’s worth mentioning that its visualized operating board will give users an unprecedented experience of easiness, convenience and efficiency.

Photo: Visualized management; Integrate desk-top development, tests and O&M operations into one platform to improve efficiency;

It is anticipated that, in future, as financial services get more scenario-centered, all the new financial products and business systems should be strong enough to withstand the avalanche-like service calling from the internet, e.g. traditional high-security businesses shifted from physical outlets to internet terminals, the peak-load payment traffic coming with shopping festivals and online promotion campaigns, precise marketing and discount preference treatments that credit card operators offer through various APP, applets, live-stream selling channels, etc. The SDS Cloud Management Platform can help financial institutes to do all development, deployment and O&M tasks on a Cloud infrastructure, and, support all kinds of high scalability capacity expansion involving all system resources.

As is said in the title of this newsletter, ‘SDS Clouds Empower Financial New Infrastructure’, such new infrastructures are what people count on to release the power of digital productivity. In this sector that’s full of challenges, the SDS is devoted to learning from industrial experiences, cooperating with experts from different technological spheres to explore new possibilities and make real innovations, and finally providing Chinese financial institutes with really strong and reliable supports in terms of information infrastructure and infrastructure integration.

中文

中文