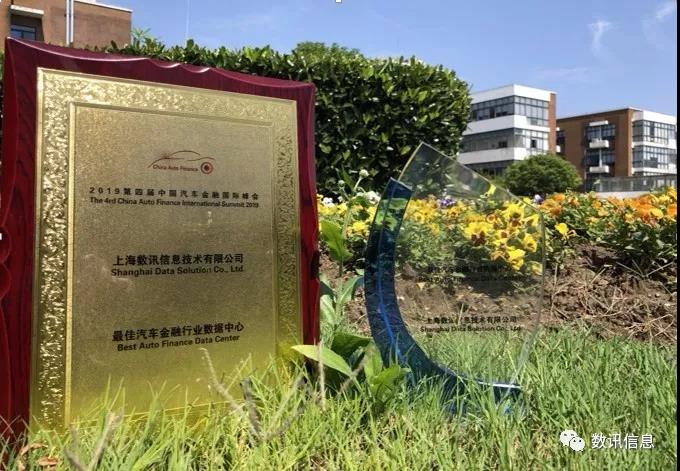

Honor: SDS Awarded as the “Best Auto Finance Data Center”!

2019-05-31

2019 is the year the China auto finance market is deep in adjustment and restructuring. Resource elements keep on concentrating in enterprises having greater innovation capacity and more competitive edges. AI and big data technologies started powering the auto finance industry in an increasingly bigger way. Industry-wide fission and innovation are imminent. To encourage and reward businesses who have made excellent contribution to the Chinese auto finance industry, the 4th China Auto Finance International Summit (2019) was held in Beijing from May 21 to 23. The Summit particularly set up a Gold Ting Award for excellent performers! It’s a great privilege that the SDS received the ‘Best Auto Finance Data Center’ award!

The three key elements, i.e. capital, financing and risk management, of Chinese auto finance industry are under strict regulation. Indeed, many policies have been worked out to encourage auto finance providers to expand business scope and explore new financing model, the state has yet relaxed any of the regulatory indicators concerning the capital, financing and risk management for the industry. The CBRC’s regulations and ranking indicator system designed for commercial banks are, in a large part, applicable to auto finance firms. Current macro prudential assessment (MPA) system and the newly-issued macro prudential capital adequacy ratio assessment (MPCARA) standard have leaded to greater capital pressure on auto finance firms. With its high financial security level and high performance level, the SDS IDX data center is able to provide all auto finance firms with reliable safeguard and all-round services. As we understand, auto finance providers pay special attention to the security level that a data center can ensure for their core operating systems, e.g. payment, retail bank and asset management. Based on strong capability, SDS has been chosen by many top players in the auto finance industry as their service vendor and, for the same reason, been selected by the industrial authority as the winner of the “Best Auto Finance Data Center” Gold Ting Award.

IDX Data Center

Top Configuration: Built by Tier4 Standards, Designed with Full Redundancy, High-end users’ expectations in a data-center met in every bit, Have servicing industry quality control authentication certificates;

High Capacity Cabinets: Strong power support, high performance data operations enabled;

Professional Services: Tailored enterprise class data-center solutions, lifecycle management (LCCM);

Connectivity: Linked directly into the backbone networks of major network operators in China, boasting of great network service quality;

Power Supply System:

- A full redundancy power supply system based on GE overall solution;

- Two 3750KVA power supply lines, linked to Two different power plants, separately connected into Two distribution cabinets located at the Two sides of the IDX;

- 2N power supply plus UPS units in isolated configuration, with host machine isolated from battery packs, to secure system stability;

- 15 minutes full load UPS operation solely powered by battery packs;

- 2+1 backup outdoor diesel power generators, no less than 2000KVA single unit capacity;

- 24-hour full load operation of diesel generators ensured by underground oil tank;

Cooling System:

- CANATAL high precision air-conditioners specially designed for computer rooms;

- Built according to the latest international DC construction standards, Design Specifications on Electronic Information Computer Rooms (TC9.9, GB50174-2010) and the energy-saving and environmental protection requirements on green data centers; 18-27℃ temperature range ensured;

- Dew-point temperature and dry-bulb temperature based temperature calculation, with relative moisture maintained within 45~65%RH range;

- 1KW~1.5KW cooling capacity per square meter ensured by every air-conditioner safeguarded with double-compressors and double-power-supply configuration; Wind-cooling down-draft ventilation design, with cold air ducts isolated from hot air ducts, to improve cooling effectiveness and energy utilization rate;

Fire Protection System:

- VESDA (Very Early Smoke Detection Apparatus) secured;

- IG541 environment-friendly fire-suppressant gas;

- Fire Protection System integrated in local area fire protection system;

Security System

- Validity of every entrance into the IDX is ensured with airport-level metal detectors and X-ray security inspection unit;

- Access authority secured with a special Identity Authentication & Registration System;

- Validity of every operation carried out by any visitor is ensured with access control system and video surveillance system in every zone;

- ID verification in special zones is ensured with biological recognition system, e.g. palm-print scanner;

- Security in special areas powered by RFID technologies;

- Basic security systems integrated in the overall local area security system;

- All doors/exits under the monitoring of access control and video surveillance systems;

In a survey made by IResearch Consulting Institute, it’s anticipated that the auto finance and financial leasing industry would maintain a 15-20% compound annual growth rate (CAGR) in the coming years. To better meet the need of smart expansion, auto finance firms also start searching mixed Cloud solutions for non-core business operations, e.g. operating outlets, human resources, and, customer analysis or customer relation platform. As we see it, there is a new trend emerging in the use of Cloud computing in the auto finance industry, i.e. the use of Cloud computing is shifting from the gradual migration of external systems to a stage where centralized architecture and distributed architecture co-exist side by side. SDS has extensive experience in designing and delivering overall mixed Cloud solutions that cover the whole process from installation to migration and then management, and, therefore, can give auto finance firms the greatest possible support for their innovation and upgrading endeavors!

Relying on its extensive experience in serving banks and financial institutions, great technical capacity, and strong project implementation record, SDS will continue providing strong support to all kinds of financial institutions with service products that feature higher security, higher reliability and better improvements and, particularly, continue helping the auto finance industry to achieve a fast but steady development, create more value for clients, and realize higher customer satisfaction!

中文

中文